Real Estate Fraud Nightmare

The truth is, there are many different F words, but the one I want to shine a light on today is fraud, specifically, real estate fraud.

Buying your dream home should feel exciting, not like you just unlocked the door to a trap. But when fraud sneaks in, that dream can unravel fast, turning into a financial and emotional nightmare.

In 2024 alone, real estate and rental scams caused over $173 million in reported losses, according to the FBI’s Internet Crime Complaint Center (IC3). More than 9,500 victims were impacted, and those are just the cases reported.

Let’s break down some common traps, so you can avoid them, protect your investment, and sleep better at night.

🏚️ The Fixer-Upper Trap: When Renovation Turns Rotten

That “great deal” on a fixer-upper can quickly become a money pit if you’re not prepared. From underhanded contractors to vanishing funds, here’s how fraud in renovation works:

🔨 Underbidding Contractors: Deals That Cost You Double

Too-good-to-be-true bids usually are. Some contractors lowball their estimates just to win your business, then pile on extra costs once the job starts. Think surprise “repair needs,” material upgrades, and correcting their own mistakes.

✅ Protect Yourself: Get detailed, itemized quotes. Ask what’s not included. Compare at least three bids and trust your gut. If it feels off, it is.

💸 Draw Schedule Fraud: When Progress Payments Disappear

Draw schedules are meant to pay contractors as they hit milestones, like framing or electrical work. Some shady contractors manipulate these timelines to get paid early, then disappear halfway through the job.

✅ Protect Yourself: Set clear, written expectations. Tie every payment to actual, verified progress. Use photos, receipts, and walkthroughs. Document everything.

💥 Funds Running Out Mid-Reno: Halfway Home, All the Headaches

You’re knee-deep in renovations, and suddenly, the money dries up. Maybe costs were underestimated. Maybe surprise problems showed up. Either way, you’re stuck, mid-demo, and over-budget.

✅ Protect Yourself: Add a 15–20% buffer to every renovation budget. Ask your lender how disbursements work and what delays you might face. Be ready for curveballs.

📜 Lender Secrets: What They Don’t Always Tell You

Many lenders gloss over how renovation loans actually work. Delayed disbursements, extra paperwork, and stage-based funding can derail your timeline fast.

✅ Protect Yourself: Read the fine print. Ask questions until you get clear answers. If your lender can’t explain funding timelines or hidden fees, walk away.

💻 Wired and Wrecked: The Email Scam That Steals Your Life’s Savings

Wire fraud is one of the fastest-growing real estate scams, and it hits when you’re most vulnerable. Right before closing.

According to CertifID, 1 in 3 real estate transactions are targeted by wire fraud attempts. Nearly 1 in 10 buyers fall for it, and 5% of those victims sent their entire life savings.

📧 Spoofed Emails: Phishing for Your Down Payment

Scammers impersonate your title company or realtor and send an urgent email with “updated” wire instructions. They spoof email addresses so they look legit.

✅ Protect Yourself: Never trust wiring instructions sent over email, always call your contact using a verified number. One phone call can save your entire savings.

🏢 Fake Title Companies: Imposters at the Closing Table

Fraudsters create fake title company websites and send official-looking documents. If you don’t verify, you could wire money straight into a criminal’s account.

✅ Protect Yourself: Verify phone numbers and emails through your realtor or lender, not from links or documents. Use secure portals whenever possible.

⚠️ How the Scam Works, Step-by-Step:

- Scammer hacks your email or researches you online.

- Sends fake wire instructions, timed days before closing.

- Urges quick action to avoid “closing delays.”

- You send funds to a fraudulent account.

- Money disappears. No way to get it back.

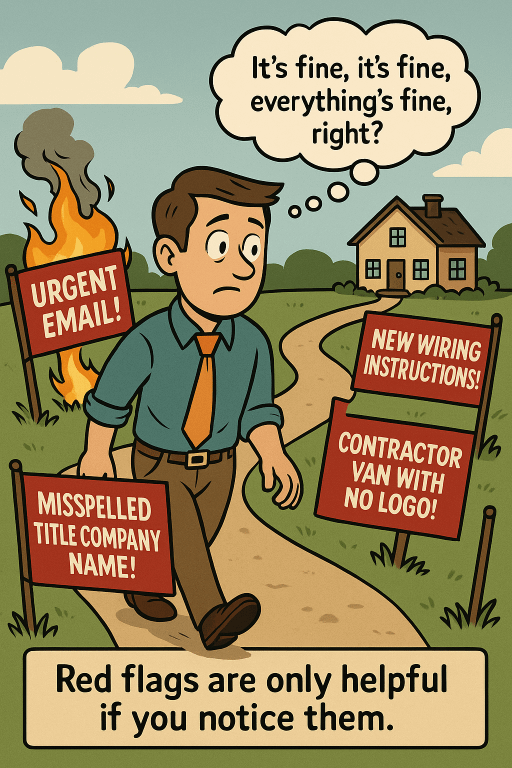

🚨 Red Flags to Watch For:

- Last-minute wiring changes

- Urgent pressure or fear tactics

- Slight misspellings in email addresses

- Requests via unsecured emails

👤 Identity Theft & Stolen Dreams: When Your Name Isn’t Yours

Real estate fraud isn’t just about money, it’s about identity. Some criminals go further, using your stolen information to buy property in your name.

🏠 When Someone Else Buys a House Using Your Identity

It starts with stolen data, your Social Security number, banking info, or a hacked email account. Before you know it, there’s a mortgage in your name… that you didn’t sign for.

✅ Protect Yourself: Monitor your credit reports and freeze them with all three bureaus. If anything suspicious shows up, act fast.

❌ Loan Denied? It Might Be Fraud

You apply for a mortgage and get denied, only to find out someone has opened credit or bought a home using your name. By the time you discover it, your credit is trashed.

✅ Protect Yourself: A credit freeze stops thieves and your own impulse purchases. It’s like a seatbelt for your financial life.

🧊 Credit Freezes: Your Fraud-Fighting Superpower

Credit freezes are free, fast, and powerful. They block new credit accounts unless you unfreeze them with a PIN or password. That means thieves, and even you, can’t open new lines of credit without taking an intentional step.

🔐 How to Freeze Your Credit:

Visit all three of the credit bureaus’ websites to freeze your credit with each.

Equifax: https://www.equifax.com/personal/credit-report-services

Experian: https://www.experian.com/help/credit-freeze/

TransUnion: https://www.transunion.com/credit-freeze

✅ Tip: Use secure passwords and store your PINs somewhere safe but accessible.

🛑 Stop Impulse Buys, Too:

A freeze doesn’t just stop fraud, it gives you a pause before saying “yes” to that tempting store credit card. It’s like future-you saying, “Let’s sleep on it.”

🎯 Final Thoughts: Gut Feelings Save Wallets

If you don’t have your own realtor, get one. Do not rely on the seller’s agent, they legally represent the seller’s interests, not yours. An experienced buyer’s agent can help you navigate red flags, review documents, and ask questions you might not know to ask.

Also, if the home is being sold by an LLC, find out who the real owner is. Make sure it’s not someone already involved in the transaction, like the broker, realtor, or title attorney. Hidden relationships like these can be a conflict of interest or a cover for something shady.

✅ Protect Yourself: Look up LLC ownership through state records or ask your agent to help. Don’t skip this step. What’s hidden behind the paperwork could cost you.

📧 Share your story at tips@thetruthaboutthefword.com to help shine a light on fraud hiding in plain sight.

Leave a Reply

You must be logged in to post a comment.