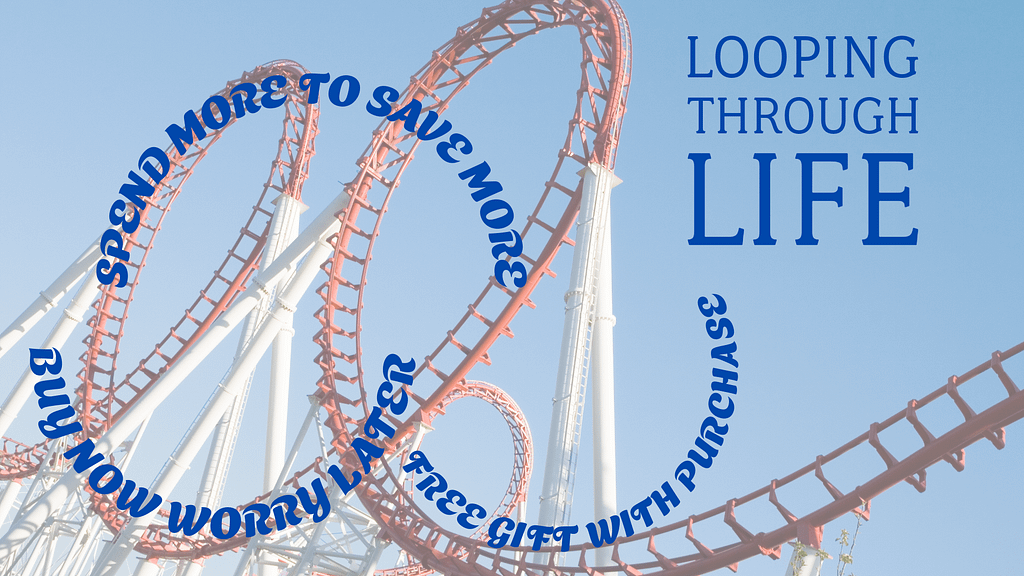

Looping Through Life

The truth is, there are many different F words, but the one I want to shine a light on today is false value, specifically, the kind that keeps you stuck in a spending loop, chasing deals, and justifying purchases you never needed in the first place.

This isn’t about being scammed in the traditional sense.

No one’s pretending to be the IRS or hacking your bank account.

This is about the manipulation we’ve learned to live with.

The kind we scroll past. The kind that lives in our inboxes, retail carts, and emotional decision-making.

The kind that makes us feel smart for spending more, and quietly chips away at our freedom.

🍀 The $5 Lucky Carebear Sweatshirt

The reason I own a one-size-too-small, bright green Care Bear St. Patrick’s Day sweatshirt isn’t because I love Care Bears.

It’s because shipping was $8.95, and the sweatshirt was $5.

It was just enough to bump me over the free shipping threshold, and less than the shipping cost itself, so into the cart it went.

At that moment, I wasn’t spending $5.

I was saving $3.95.

Never mind the 30+ minutes I spent scrolling the clearance graveyard, trying to find something that wasn’t too expensive, ugly, or pointless.

(Spoiler: it was all three.)

That time? Gone forever.

That logic? Shaky at best.

Those savings? Pure emotional math.

The $5 Sweatshirt Makes Its Debut

The one time I actually wore the sweatshirt?

It was summer in Florida.

The house was freezing. The A/C was on full blast.

I was lounging in flannel sleep bottoms and that neon green Care Bear sweatshirt, hanging out with my mom because she had just received a copy of my first book in the mail, and I hadn’t even seen it yet.

It was a quiet Sunday afternoon until my daughter came running inside.

“Can I bring him in? He’s in the driveway. He wants to meet you.”

And before I could even process what was happening, there they were, walking into the living room.

Her boyfriend. Meeting me for the very first time.

There I sat, dressed like a clearance rack punchline, next to my mother, holding a fresh copy of my own published book, when my mom casually said:

“Melissa wrote a book.”

And hands it to him.

So now he’s meeting me, his girlfriend’s mother, for the first time, in a green Care Bear sweatshirt and flannel pajama pants, while being handed my literary work like we’re opening negotiations.

Not a scam.

Not fraud.

But absolutely a loop I got pulled into, and a moment I’ll never live down.

It’s Not Just Kohl’s. These Loops Are Everywhere.

These traps aren’t accidental. They’re loops. And they’re everywhere.

- 🎁 Free gift with purchase that you didn’t need in the first place

- 🚨 One-day flash sales that happen every three days

- 🧼 Buy more, save more, which actually costs you double

- 📦 Free shipping on orders over $49, which gets you spending $70

- 🎯 Rewards points that expire the day before you remember to use them

- 🧃 Monthly subscriptions you forget about but justify because they’re “only $5”

- 🎉 Double your tax refund if you put the whole thing down on a new car

- 💳 0% financing that costs you your exit plan when you hate your job

These aren’t scams.

They’re emotional algorithms.

They tap into your guilt, urgency, loyalty, scarcity, and shame.

They make you feel like you’re winning while you’re actually spending more, losing control, and justifying things you don’t even want.

💪It’s Not Just Money, It’s About Power

And here’s the part no one talks about:

These nudges don’t just take your cash.

They take your freedom.

Because when you’re constantly reacting, spending to please, buying to feel better, swiping to soothe, you’re not in control.

You’re handing your choices over to someone else’s bottom line.

I’ve heard people say, “Money gives you freedom. Money gives you choices.”

And they’re not wrong.

But here’s the thing:

We all have choices to make with our money.

And I’ve made a lot of wrong ones.

Not because I was reckless.

But because I was manipulated into believing I was being smart.

Spending to avoid guilt.

Saying yes because the deal was “too good.”

Pushing purchases into the future because “I’ll figure it out later.”

But when those choices stack up?

So does the pressure.

So does the debt.

So does the cost of saying yes when you desperately want to say no.

Like signing up for an $800 car payment, not because you needed the car, but because the rebates, trade-in offer, and 0% interest made it feel like a financial flex.

Like dropping your entire tax refund because a dealership promised to match it.

Only to realize later you emptied your emergency fund and committed to years of “affordable” payments that cost you the freedom to leave a toxic job.

You didn’t double your money.

You just disguised the cost.

And When You Try to Undo It? The Loop Tightens

Let’s say you return something.

You’d think you’d get back the $50 you paid, right?

Nope.

Not after the promo codes, reward deductions, and coupon stacks.

Suddenly, that $50 item is worth $6.87, unless you can find something in the store that matches the exact original price. Not a penny more or less.

It’s not a refund.

It’s a maze.

🕶️I Didn’t See Myself Stuck in Loops Until Now

I’ve lived in these loops.

I’ve justified them.

I’ve smiled while doing them.

But only now do I see them for what they really are: a system of quiet, constant control.

Not a scam.

Not illegal.

Just strategic emotional manipulation, dressed up as convenience, reward, and self-care.

I didn’t know how much time, energy, and freedom I’d traded for points, discounts, and fake savings.

Until now.

🃏The House Always Wins

I’ve worked the other side of manipulation, too.

I was a blackjack dealer at 21.

They brought me in when the table was hot, players were winning, and the house needed its edge back.

I could flip the energy. I knew how to cool a table without anyone noticing.

I’d even warn them:

“It’s not hot anymore. I’m taking now.”

But they didn’t believe me.

They thought they could win it back.

They almost never did.

Even my husband once came to my table.

I told him:

“If you put that $50 chip down, I’ll take it and won’t give it back.”

He did.

I did.

I was a house cleaner.

I knew how to take, but only after I gave enough to fill my tip jar.

And that’s how the system works now.

Retail. Rewards. Deals.

They give just enough to make you feel like you’re in control.

And then they take.

The System Doesn’t Have to Scam You. It Just Has to Make You Say Yes.

One $5 sweatshirt.

One “can’t-miss” deal.

One justified moment at a time.

And before you know it, you’re trapped in a cycle of spending, guilt, justification, and stress, while the system keeps cashing in.

🕒 Time to Exit the Loop

This isn’t just about smarter shopping.

This is about reclaiming your attention, emotion, and power.

💬 Have a story like this?

A deal that cost you more than money?

📩 Send it to tips@thetruthaboutthefword.com

Your story might just be the one that helps someone else step out of the loop.

📣 And share this with someone who needs to see the system for what it is.

Because the more we recognize these everyday manipulations, the harder it becomes to be manipulated by anyone.

Because the only F word we’re not saying around here?

Fooled.

Leave a Reply

You must be logged in to post a comment.